How Much Money Do I Need To Buy A House Calculator

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

When you're in the market for a new home, it may be tempting to try to buy the biggest or most expensive house you can afford based on the number you find on your preapproval letter. However, the loan amount you qualify for doesn't necessarily represent how much house you can afford. Just because a lender is willing to give you a mortgage for a certain amount of money doesn't mean you'll be able to pay it back in the end. Instead of taking a leap and suffering for it later, use our home affordability calculator and read through our tips to determine how much house you can afford on your budget.

Home Affordability Calculator

Our home affordability calculator is a simple way to play around with numbers and estimate home much home you can afford. As you test out the home affordability calculator, learn more about its capabilities below.

How To Use The Home Affordability Calculator

After entering in basic information about your annual income, monthly debts, savings and location, this online tool calculates a few different estimates you can use to begin your home search, such as: Once you know how much house you can afford, you can also use our Mortgage Calculator to see how your down payment will impact your monthly mortgage payments. By trying out this calculator, you'll be able to see how putting down specific dollar amounts or percentages of the purchase price can make your monthly payments more or less affordable. Since these online tools only provide estimates based on the information you enter, it's useful to learn more about how home affordability is determined. In the sections below, you'll find everything you need to know.

Factors That Determine How Much House You Can Afford

There are four main factors that affect home affordability. When trying to figure out how much house you can afford, you must consider your income, cash reserves, debt and expenses and credit profile. Here's how each will impact the amount of money you can spend on a new home. The amount of money you earn through your salary, side jobs and investments will determine how much you can afford to spend on monthly mortgage payments. Calculating your total gross monthly income is the first step to figuring out the range of homes in your budget. The amount of money you have at your disposal based on savings, investments, gifts, etc. will determine how much you can afford to spend on a down payment and closing costs. The more funds you have available, the higher your down payment can be, which will enable you to either lower your monthly mortgage payments or purchase a home on the higher end of your budget. Along with your income, your monthly debt payments and expenses will play a critical role in how much you can spend on a house. The more money you have to spend to pay off credit cards, student loans, car payments and alimony, the less you'll have to pay for a mortgage and housing-related expenses. But your groceries, utilities, telephone bills and other necessities must also be factored in to ensure you have enough money available for day-to-day living expenses. When determining whether you qualify for a mortgage, lenders examine your credit score and debt profile. Individuals with higher credit scores and lower debts have an easier time qualifying for a mortgage and typically receive more funds from lenders.Income

Cash Reserves

Debt And Expenses

Credit Profile

How Do Lenders Determine How Much Mortgage I Qualify For?

Before you figure out how much house you can afford, it's useful to know how lenders calculate whether you qualify for a mortgage. Mortgage lenders determine your qualification based on your credit score and debt-to-income ratio (DTI). Your DTI enables lenders to evaluate your qualifications by weighing your income against your recurring debts. Based on this number, lenders will decide how much additional debt you'll be able to manage when it comes to your mortgage. To see if you'll qualify for a mortgage, you can begin by calculating your DTI: DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100 Once you have calculated your DTI, you can evaluate whether it's low enough to get approved for a mortgage. The lower your DTI, the more likely you'll get approval. If your total monthly debt is $650 (let's say, $160 for your student loans + $370 for your car loans + $120 for your credit card debt), and your monthly income is $4,500 before taxes, your DTI would be 14%. A DTI of 14% is quite low, so you'd be likely to obtain a mortgage. Very rarely will mortgage lenders give a loan to an individual whose DTI is above 43%. After calculating your DTI ratio, if you find that it's over 43%, you'll need to work on lowering it.

Tips For Improving DTI Ratio

The only ways to really improve your DTI are by increasing your income or paying down your debt. Let's take a closer look at the ways you can increase your gross monthly income and lower your total monthly debt payments. Because your DTI is a ratio that calculates the percentage of your income that's spent on paying off debt, any extra money you make will automatically improve your DTI. It's helpful to begin lowering your DTI by increasing the amount of money you take home each month. Here are some ways that you can boost your take-home pay: The key to reducing your debts is to create a budget and debt payment plan. By creating a list with your total monthly income on one side and all of your expenses on the other, you can quickly identify unnecessary expenditures, eliminate them and allocate extra funds to paying off your loans early. After coming up with your budget, you can use one of the following debt payment plans to chip away at your debts. Although you can choose to focus on either increasing your monthly income or lowering your debts, it's recommended that you do both simultaneously. Doing so will enable you to improve your DTI faster and ensure you can qualify for a mortgage when it's time to apply.Ways To Increase Your Gross Monthly Income

Ways To Lower Your Total Monthly Debt Payments

Avoid The Pitfalls When Determining How Much House You Can Afford

When determining how much house they can afford, people tend to use two basic strategies. Most base their assessment on how large of a loan lenders are willing to give them. But others use their current rent to determine how much they can afford to spend on monthly mortgage payments. The problem with these two approaches is that they tend to lead people to overestimate their budgets. To know how much house you can afford, you not only need to think about how much you have saved but how much you'll be spending. Even though you'll no longer be spending money on rent, you'll have a slew of new payments that you need to consider, such as closing costs, property taxes, homeowners insurance and fees. And if the home you purchase needs work, you'll also have to factor in the cost of home improvements.

'How Much House Can I Afford' Rule Of Thumb

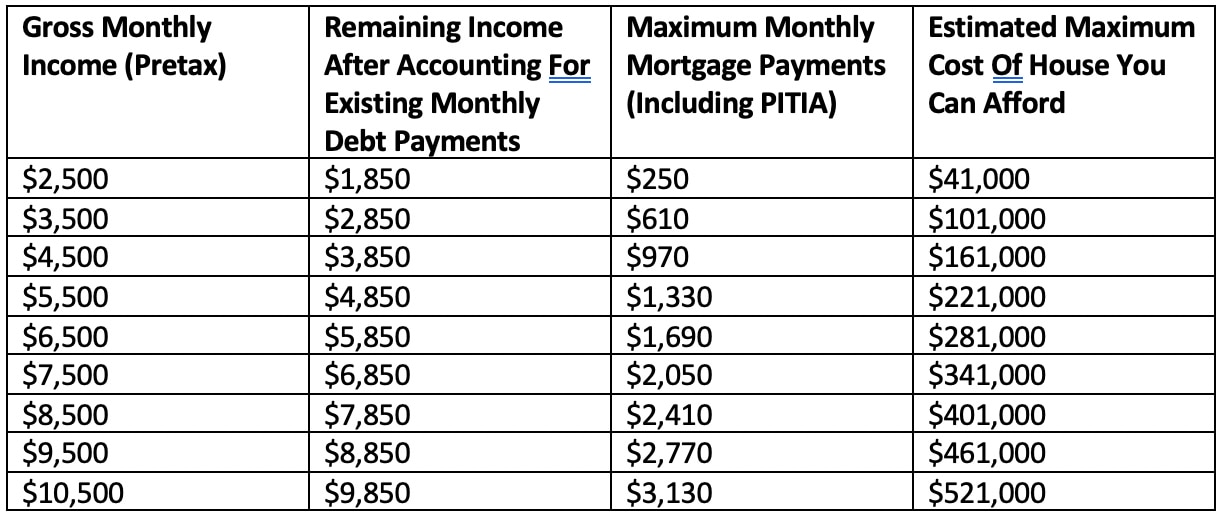

When deciding how much house you can afford, the general rule of thumb is known as the 28/36% rule. This rule dictates that individuals should avoid spending beyond 28% of their gross monthly income on housing expenses and 36% on their total monthly debt payments. The highest possible front-end ratio, represented by the 28%, is the largest percentage of your income that should be allotted to mortgage payments. And 36% represents the highest possible back-end ratio, also referred to as the debt-to-income ratio, which you now know is the percentage of your income that's set aside to pay off debt. Before asking "how much house can I afford," it's necessary to have a firm grasp of what falls into the category of housing expenses, the real cost of buying a home. These costs are the various components of your monthly mortgage payment, which are often referred to as the PITIA: To determine how much house you can afford, you should do the following calculations: (Gross Monthly Income x 28) / 100 = Maximum Monthly Housing Expenses (Gross Monthly Income x 36) / 100 = Maximum Total Monthly Debt Payments For a gross monthly income of $4,500, you shouldn't spend more than $1,260 on housing expenses and $1,620 on debt payments each month. Now, $1,620 may seem relatively high, but don't forget, you still have to factor in the debt payments you're already making. So, $1,620 - $650 = $970. That means you'd only be able to afford a monthly mortgage payment of $970. The chart below illustrates the maximum monthly mortgage payment you could afford based on different income levels.

How To Look Beyond The Monthly Mortgage Payment

Given the "how much house can I afford" rule of thumb, you now know that you can afford a monthly mortgage payment of $970. But that's only so helpful. You're still probably wondering how much house you can afford? Well, the answer depends on how much money you've saved. When you buy a house, you're going to need money upfront for closing costs and a down payment. Closing costs are the fees associated with finalizing your loan, including application, origination, appraisal, credit report, title and attorney fees. Closing costs typically run about 5% of the purchase price of your home. When obtaining a mortgage, you also have a down payment on your house, which is the money you pay upfront. The good news is that this sum is subtracted from your total mortgage amount. The more money you set aside for your down payment, the less you'll have to spend each month on mortgage payments. The cost of your down payment will vary based on the purchase price of your home and the type of loan you obtain. Conventional loans require borrowers to pay a more significant percentage of the purchase price upfront than do government-backed mortgages. Conventional loans typically require a down payment of 3 – 20% of the purchase price. Yet, if you put down less than 20%, your lender will require you to pay private mortgage insurance (PMI) fees to safeguard the mortgage company in the event that you default on your loan. Let's take a look at an example. While the chart in the previous section demonstrated the maximum monthly payments you could afford to make based on varying income levels, the chart below presents a concrete example of how much house you could afford. Say you're able to make a 20% down payment. You have excellent credit, and your existing monthly debts total $650. You want to obtain a conventional 30-year fixed-rate mortgage for a house in Detroit, Michigan and believe you can lock in an interest rate of 4%. Here's how much house you could afford based on a range of gross monthly incomes:

How Much Home You Can Afford With Different Loan Types

As mentioned, the examples above are based on a conventional loan with a 20% down payment and an excellent credit score. However, to obtain a conventional loan, you must have the ability to make a substantial down payment – if less than 20%, you usually must pay for PMI – and a credit score of at least 620. Depending on your circumstances, you may find that a conventional loan isn't right for you due to limited savings or mediocre credit. If this is the case, you should consider a government-backed mortgage. Government-backed loans, such as FHA and VA loans, are good alternatives, as they provide borrowers with lower eligibility requirements and some relief when it comes to down payments. However, you must be eligible for these loans to reap the benefits. Because FHA loans are guaranteed by the Federal Housing Administration, the requirements for qualifying for this type of mortgage are more lenient. If you're purchasing a primary residence, have a minimum credit score of 580 and a DTI of 43% or less, you may be able to qualify for an FHA loan. If you can obtain an FHA loan, you'll be able to make a down payment that's as low as 3.5% of the purchasing price of the house. If your credit score is between 500 – 580, you may still qualify for an FHA loan, but you'll have to make a down payment of 10%. VA loans are mortgages insured by the U.S. Department of Veterans Affairs. These loans are made available to eligible current and former members of the U.S. military, National Guard or military reserves. Spouses of veterans who died during active duty, are missing in action or are a POW may also qualify. Getting a VA-backed loan enables qualified borrowers to purchase a property they plan to live in without having to make a down payment or pay for PMI. Although the VA doesn't require any specific credit score to qualify, lenders are able to set their own requirements. Shop around for your best option.FHA Loan

VA Loan

How Does The Down Payment Affect How Much House I Can Afford?

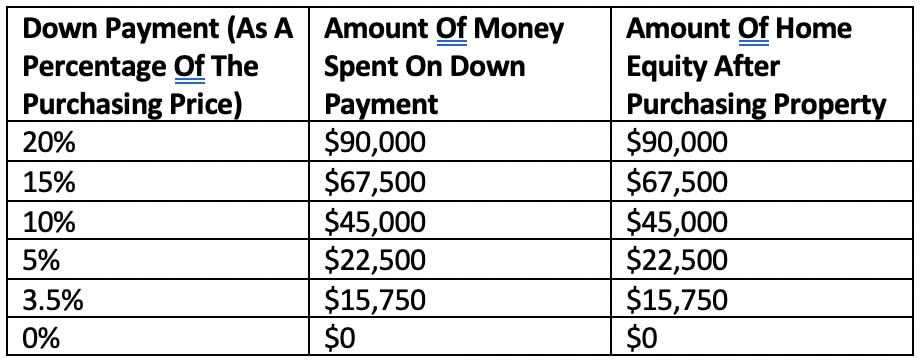

It's crucial to consider your down payment before determining how much house you can afford because the money you put down will drain a considerable amount of your savings. If you use up your savings on a down payment and have earmarked too much of your income for paying off your mortgage and other debts, you'll find yourself in serious financial trouble should any emergencies or unforeseen expenses occur. The higher the down payment you can make, the more equity you'll have in your home after you purchase it. Let's take a look at how the size of your down payment would impact your home equity if you were purchasing a home for $450,000.

Although down payments can be lower than 20% of the purchasing price, you should really try to stay as close to that number as possible, especially if you're in the market for a conventional loan. You don't want to get stuck paying PMI fees. But more importantly, you need to remember that the less you put down now, the more you'll have to spend each month on your mortgage payments and the less equity you'll have in your home.

Words To Remember When Determining How Much House You Can Afford

Even if you're inclined to buy a house priced in line with the maximum loan amount a lender is willing to give you, remember that's not the wisest decision. When Dennis Spensley, Triple Crown Mortgage Banker at Rocket Mortgage®, works with clients, he makes sure that they have a precise understanding of what they're getting into. "I explain the debt ratios that we work off of, but I also let them know that what we're comfortable with and what they're comfortable with may be two different things," he says. "They will be writing the check every month to us, and if they are not comfortable with the payment, I tell them that they should either lower their max purchase price or if they cannot find something in a lower price range, they should continue to rent," Spensley adds. "I let them know that ethically, I do not want to be responsible for putting them into a bad loan." Just because a mortgage lender offers you a certain amount of money doesn't mean you should take it. Instead of maxing out your budget and buying a house that may cause you financial distress in the future, you should choose a home that meets all your needs but costs the least amount. Read our other resources on the home buying process to learn what makes the most sense for you.

How Much Money Do I Need To Buy A House Calculator

Source: https://www.rockethq.com/learn/home-buying/how-much-house-can-i-afford

Posted by: lindsayfatinvand.blogspot.com

0 Response to "How Much Money Do I Need To Buy A House Calculator"

Post a Comment